Singapore

Singapore is a renowned global business hub, famous for its ease of doing business, political stability, excellent infrastructure, and pro-business regulatory frameworks. Whether you’re an entrepreneur, an SME owner, or a larger enterprise, registering a company and opening a corporate bank account in Singapore offers access to regional markets, robust financial services, and tax advantages—such as a flat 17% corporate tax rate.

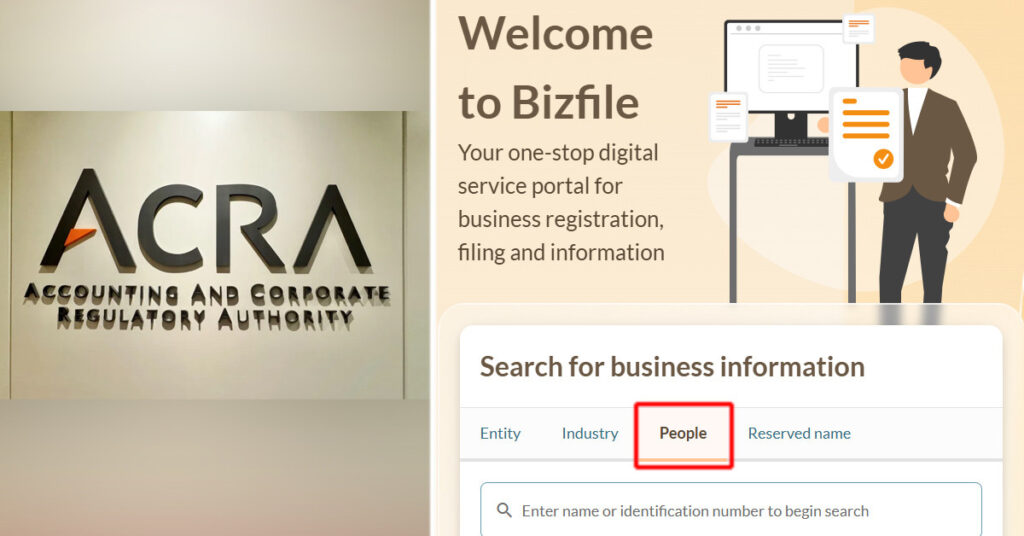

This guide dives into the company incorporation process with ACRA (Accounting and Corporate Regulatory Authority), the role of a company secretary, securing licences, setting up a corporate bank account, downtime procedures, and how to run your newly registered entity in compliance with Singapore regulations.

Singapore

Several factors make Singapore attractive:

Ease of incorporation

According to global indices, it takes just a couple of days to register a company via the BizFile+

Tax efficiency

A flat 17% corporate tax, with extensive exemptions and benefits for startups and SMEs.

Transparent, reliable legal system

based on English common law, with strong enforcement and investor protection.

Sophisticated banking

Ecosystem, featuring local giants (DBS, OCBC, UOB) alongside global financial institutions and digital banks.

Strategic location

Multilingual workforce, and strong international trade connections.

Setting Up a Company

Business Structure

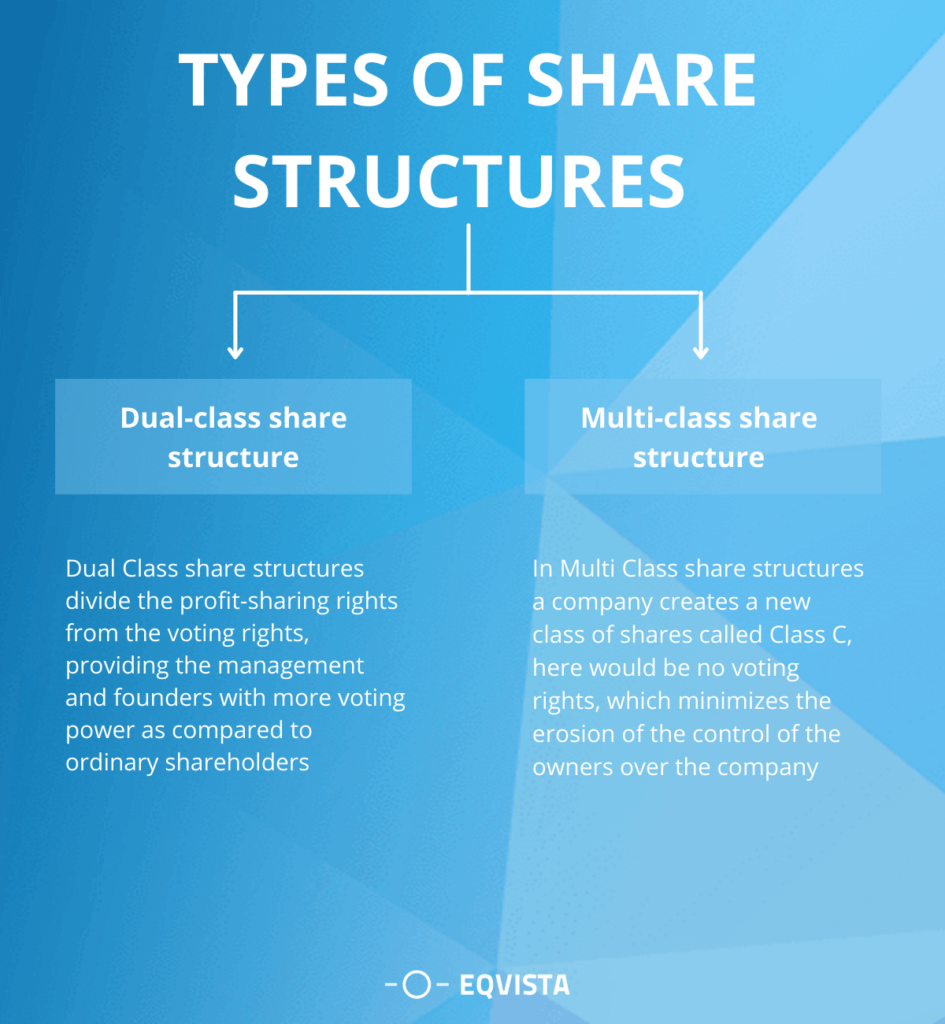

- Most foreign entrepreneurs opt for a Private Limited Company (Pte Ltd)—limits shareholder liability and offers credibility.

- Requires 1–50 shareholders, who may be individuals or corporate entities 3ecpa.com.sg+1sproutasia.com+1reddit.comfintaxx.in.

Minimum Requirements

- Share capital: Minimum S$1 paid-up—though higher capital may increase credibility fintaxx.in+1sproutasia.com+1.

- Directors: At least one resident director (Singapore citizen, PR, or holder of valid Employment/EntrePass) incorp.asia+9fintaxx.in+9kangoanywhere.com+9.

- Company Secretary: Must be appointed within 6 months, must be resident and not the same as sole director reddit.com.

- Registered address: A physical Singapore address—PO boxes are not permitted singaporecompanyincorporation.sg+3fintaxx.in+33ecpa.com.sg+3.

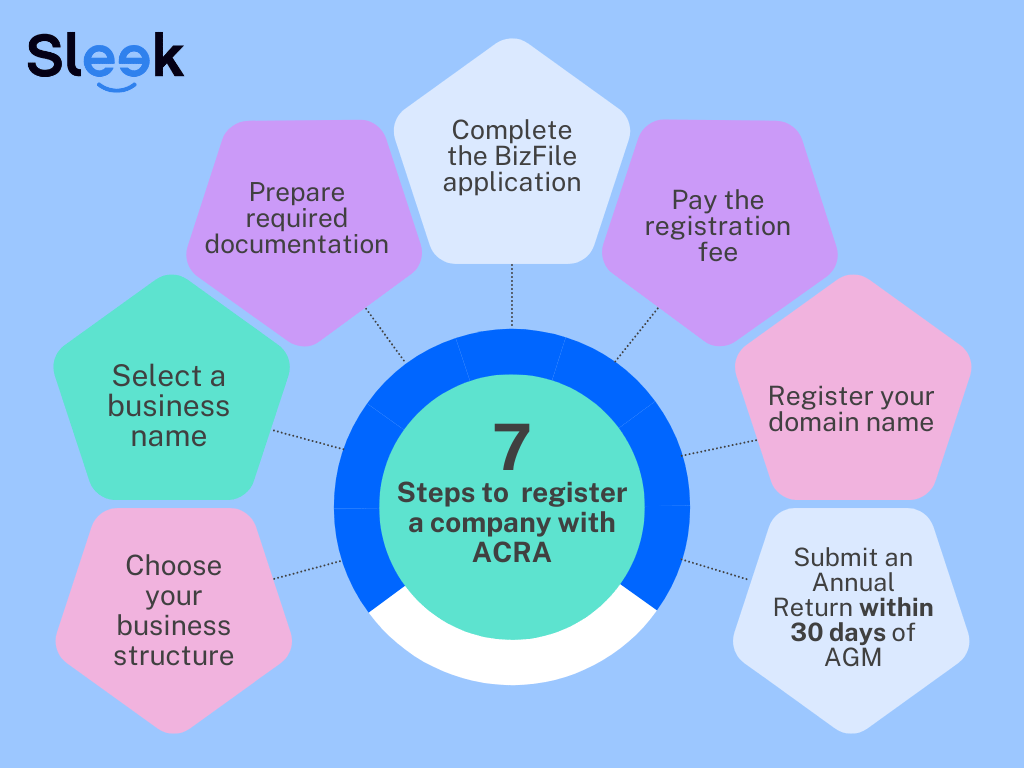

Name Approval & Incorporation via ACRA

- Reserve company name on BizFile+ (valid 120 days) via ACRA fintaxx.in+7kangoanywhere.com+7reddit.com+7.

- Incorporation documents include:

- Company name and unique description (SSIC code)

- Constitution (formerly M&A)

- Details of shareholders, directors, secretary

- Registered address

- Paid-up capital

- Submit online on BizFile+—ACRA processes within 1–2 days; typical fee approx. SGD 315 fintaxx.in+11kangoanywhere.com+11incorp.asia+11.

Once approved, your company receives a Unique Entity Number (UEN)—equivalent to company ID.

Licences & Permits

Depending on your trade, additional licences may be required (e.g., F&B, financial services, onshore operations). The Online Business Licensing System (OBLS) allows you to apply for over 260 licences from 30+ agencies in one go kangoanywhere.comen.wikipedia.org.

Opening a Corporate Bank Account

Separating business and personal finances enhances credibility, regulatory compliance, and limit complications during audits or tax filing.

Banks in Singapore

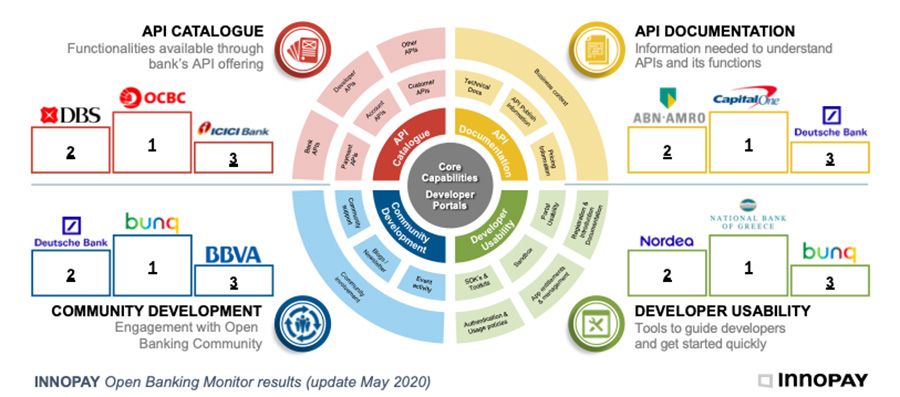

- Local banks: DBS, OCBC, UOB—customer-friendly, lower fees, streamlined services reddit.com+4en.wikipedia.org+4indiafilings.com+4contactone.com.sg.

- International banks: HSBC, Standard Chartered—higher thresholds and greater requirements .

- Niche branches: SBI Singapore, digital banks (Grab‑Singtel, Sea, Ant, Greenland) indiafilings.com+15en.wikipedia.org+153ecpa.com.sg+15.

Key Requirements & Documents

- Company documents (UEN, Certificate of Incorporation, Business Profile, Constitution)

- Board resolution approving account opening & signatories

- Identification and proof of address for directors, shareholders, and UBOs

- Background of UBOs (CV, bio, website)

- Business plan and expected account activity reddit.com+14aseanbriefing.com+14singaporecompanyincorporation.sg+143ecpa.com.sg+4incorp.asia+4singaporecompanyincorporation.sg+4

- Minimum initial deposits (SGD 1,000–100,000) reddit.com+23ecpa.com.sg+2kangoanywhere.com+2.

Opening Process & Timeline

- In-person presence often required for signatories, though remote notarization is possible at some branches abroad .

- Due diligence (KYC, AML, FATF compliance) can take 1–4 weeks; longer for foreign setups or higher-risk jurisdictions singaporecompanyincorporation.sg.

- Local banks typically waive initial account setup fees; fees depend on bank and account tier sproutasia.com.

- Banks may impose monthly maintenance charges if balance falls below prescribed minimums .

Account Management Features

- Internet banking, mobile apps

- Multi-currency options, debit cards

- Integration with bookkeeping software

- SME-focused accounts (e.g., DBS IBiz, OCBC Business Account, UOB eBusiness) singaporecompanyincorporation.sg.

Post-Incorporation Compliance & Governance

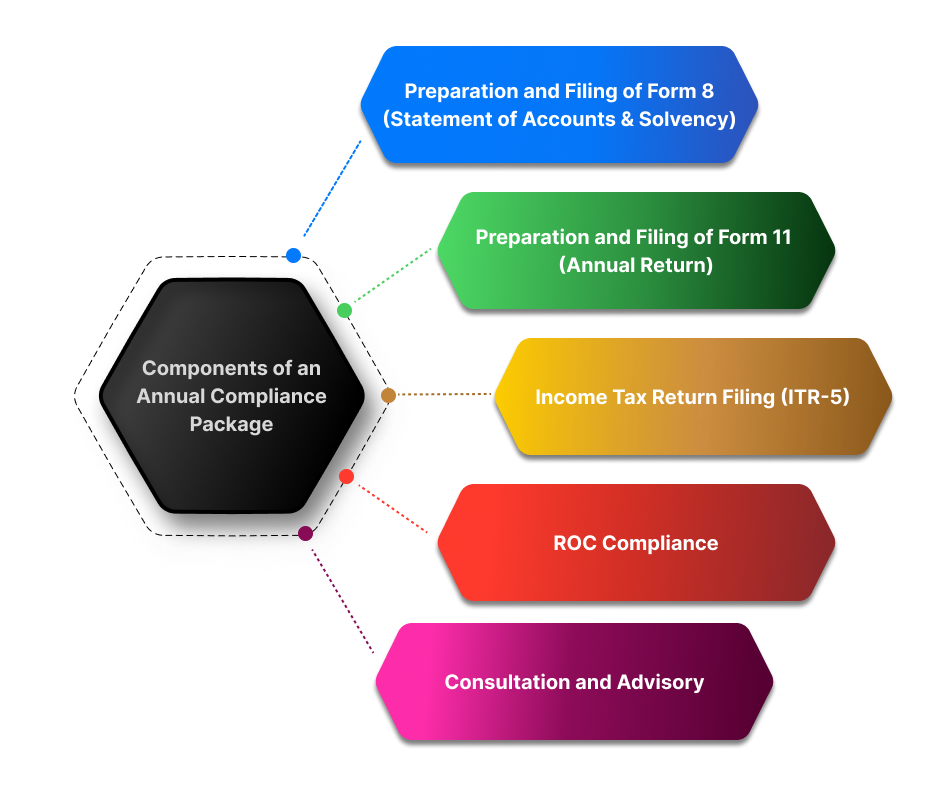

Annual Filings

- Annual return with ACRA (via BizFile+) within a month of AGM date.

- Income tax filing via IRAS; financial statements filing depends on audit exemption criteria.

- Remuneration of secretary, directors, filing fees.

Statutory Records & Registers

Company must maintain:

- Register of shareholders

- Directors’ register

- Registers for charges/mortgages

- Minutes of meetings and resolutions

- Official company seal (optional in Singapore)

Company secretary must verify accuracy.

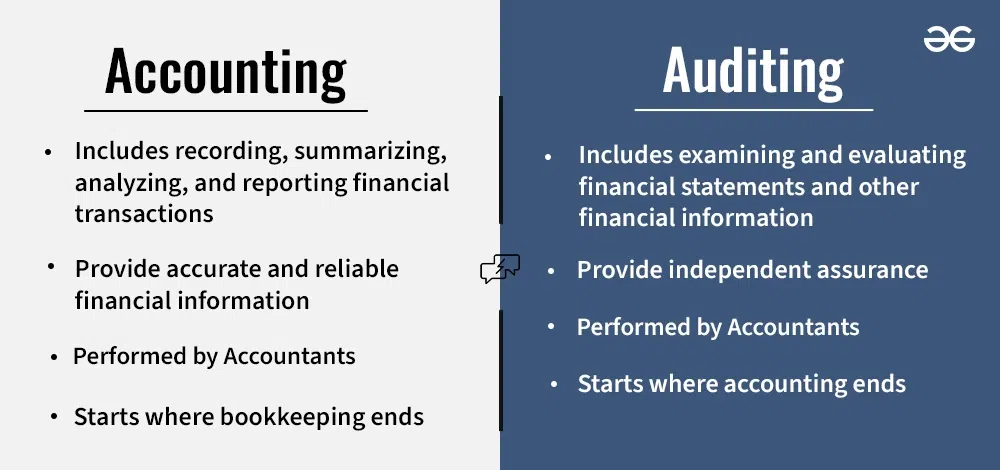

Accounting & Auditing

- Annual accounts prepared per Singapore Financial Reporting Standards.

- Most small companies can apply for audit exemption if they meet at least two of:

- Revenue ≤ S$10 million

- Total assets ≤ S$10 million

- Employees ≤ 50 en.wikipedia.org+2kangoanywhere.com+2reddit.com+2reddit.com+3fintaxx.in+3en.wikipedia.org+3reddit.com+11singaporecompanyincorporation.sg+11sproutasia.com+11sproutasia.com+1gobusiness.gov.sg+1.

- Outsourcing to professional firms is common.

Cost Breakdown

Incorporation:

- ACRA name reservation + incorporation: SGD 315

- Registered address + secretary fee: SGD 300–1,200/year

- Paid-up capital: start from S$1 (higher capital increases business image)

Bank account

- Initial deposits: S$1K–100K depending on bank type

- Monthly/annual fees if balance falls below threshold

- Possible remote notarization fees

Annual costs

- Secretary & registered address: SGD 600–1,500

- Accounting & tax support: SGD 1,000–3,000

- ACRA annual filing fee: circa SGD 60

- Audit (optional for small firms): SGD 500–5,000

A Reddit entrepreneur noted Pte Ltd costs for corporate secretarial services and filings typically start from S$2–3K annually reddit.com+4kangoanywhere.com+4reddit.com+4sproutasia.comen.wikipedia.org+15en.wikipedia.org+15rikvin.com+15reddit.com.

Practical Insights from the Field

A Singapore-based solo freelance operator shared:

“To open a bank account for your company, you will need to provide an ACRA number (UEN)… It’s better to have separate bank account for audit trail and accounting purposes.” en.wikipedia.org+5reddit.com+5reddit.com+5

Another advised:

“A Pte Ltd structure comes with significant additional compliance costs … Calculate total compliance costs versus tax benefits.” reddit.com

For more complex service providers, one user noted issues:

“Mistakenly renamed my company… not reserve new company name… charged… legally card fraud.” — negative experiences with some corporate service providers reddit.com+1reddit.com+1

These highlight the value of careful planning, accurate paperwork, and choosing reputable providers.

Working with Government Agencies

1.ACRA

- The sole regulator for business registration, corporate governance, secretaries, and reporting .

- Offers BizFile+ for electronic submission and updates.

- Recent user-friendly updates rolled out in December 2024 en.wikipedia.org+1kangoanywhere.com+1.

2.Enterprise Singapore

- Supports SMEs and startups through grants, R&D funding, market access, and standardization .

- Useful for scaling businesses, incubators, and innovationist.

3.IRAS

- Issues corporate Tax Identification Number (TIN) via UEN.

- Firms file their estimated chargeable income and annual tax returns.

4.MAS

- The Monetary Authority of Singapore oversees further banking licensing and digital banking platforms reddit.com+1kangoanywhere.com+1sproutasia.com+3en.wikipedia.org+3contactone.com.sg+3.

- In 2020–21, MAS awarded digital banking licences to several tech consortiums (Grab-Singtel, Sea, Ant, Greenland) en.wikipedia.org.

Common Pitfalls & Risks

- Insufficient documentation: Missing bank resolutions, uncertified documents may delay approvals.

- Non‑presence: Remote setup may require notarization or overseas branches—may still delay 2–4 weeks kangoanywhere.com.

- AML/KYC heightened scrutiny: Especially for foreign-owned firms or clients from FATF-listed regions 3ecpa.com.sg+2singaporecompanyincorporation.sg+2sproutasia.com+2.

- Compliance burden: Auditor requirements, annual returns, tax filings, secretary duties, and mandatory records are ongoing responsibilities.

- Service provider errors: Reputable corporate service firms reduce risk—Reddit warns of mistakes with others .

Step-by-Step Walkthrough

Step | Task |

1 | Choose business structure, name & SSIC |

2 | Reserve name via BizFile+ |

3 | Compile documents (MOA, directors, address) |

4 | Submit incorporation via BizFile+ |

5 | UEN issued; setup statutory registers |

6 | Appoint Company Secretary |

7 | Open corporate bank account |

8 | Apply for licences via OBLS |

9 | Register for GST (if >S$1 m revenue) |

10 | Ongoing compliance & filings |

Conclusion

Establishing a company and bank presence in Singapore is highly advantageous—but it requires organized planning, thorough documentation, and regulatory compliance. The steps are:

- Incorporate via ACRA and BizFile+

- Appoint a qualified resident corporate secretary

- Open a corporate bank account with one of the main banks

- Maintain annual secretarial, accounting, and tax filings

- Stay compliant with AML/KYC, licences, and renewals

When done right, corporations enjoy access to world-class financial infrastructure, tax-friendly policies, and a gateway to Asia’s booming markets.